Data Shows Lead Batteries Remain Important Motive Power and Stationary Battery Solution Well into Future

The lead battery landscape is changing, but North American demand for lead batteries in the industrial marketplace continues. That’s according to battery expert Nick Starita who presented at the 2022 Battery Council International (BCI) Convention + Power Mart Expo, held in May in Naples, Florida.

Starita is president of the Energy Solutions Division at Hollingsworth and Vose, a global manufacturer of advanced materials used in filtration, battery and industrial applications.

A Wealth of Information on Industrial Lead Batteries

His presentation, “North American Industrial Battery Market Forecast ‘22–’24,” provided an overview of the two distinct industrial lead battery market sectors: motive power batteries – also known as traction batteries – and stationary batteries, which are used for standby power, also defined as emergency power.

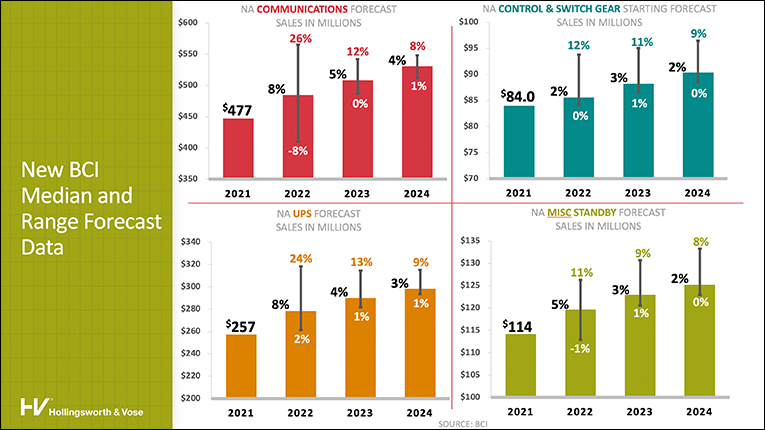

For motive power, he segmented lead batteries by their use in mining, railroad and industrial trucks (primarily lead batteries in electric forklifts). Stationary battery data was segmented into miscellaneous standby, uninterruptable power supply (UPS), control and switchgear, and communications.

Starita’s data was drawn, in part, from segment-growth information provided by BCI members and other industry experts. He began by offering a roundup of the 2021 industrial lead battery marketplace.

Overview of 2021 Motive Power in North America

Motive batteries are the heartbeat of many industry operations. A motive battery powers the motor that drives an electric vehicle, such as a forklift truck; they also provide power for a specific purpose on an electric vehicle, such as the lift on a forklift truck. Additionally, motive batteries power accessories like headlights and other safety features.

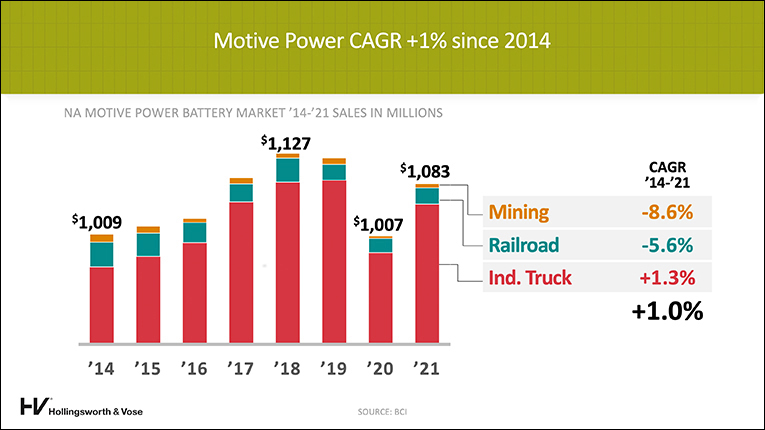

Data from his overview of motive power market performance in 2021 showed a growth of 7.5%, with a CAGR of 1% since 2014.

Other statistics reported:

- Motive battery units increased 5.3% in 2021.

- Electrification continues: The percent of electric lift trucks vs. ICE grew from 59% in 2014 to 73% in 2021. Most of this growth is in warehouse material handling.

- U.S. original equipment manufacturers (OEM) electric industrial lift truck shipments were up a record 10.3% in 2021, but there is “tons of market distortion,” which may interfere with true demand.

Starita reported that year-long lead times on truck orders and other supply chain problems have created an opportunity for lead battery imports. Although BCI members represent about 85 to 90% of this market while lithium-ion batteries are 4% of units and 10% of sales.

“We keep an eye on if OEMs – the truck manufacturers – would ever try to backward integrate and get into lithium themselves or batteries themselves … but we haven’t really seen that,” Starita concluded.

2022–2024 Forecast for Motive Power

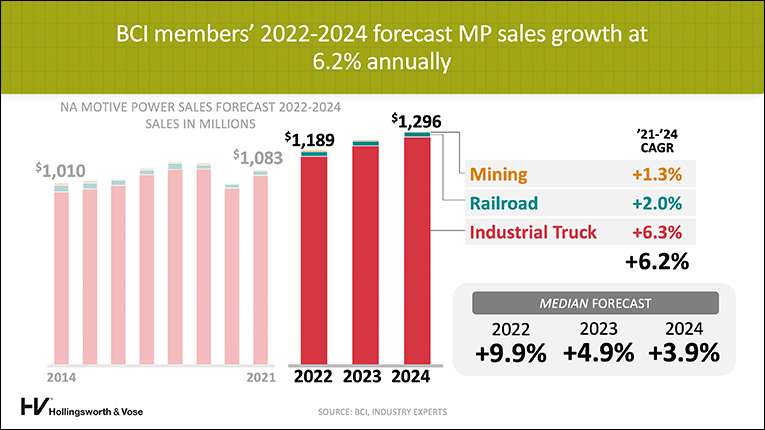

BCI members are predicting a median forecast of 6.2% CAGR for motive power bringing the market in at just under $1.3 billion. Starita predicted about 10% growth in 2022, then 5% and 4% in the next two years.

“Motive power has really strong demand … we’ll see orders going well out into 2023,” driven by strong truck sales,” said Starita.

Overview of 2021 Stationary Power in North America

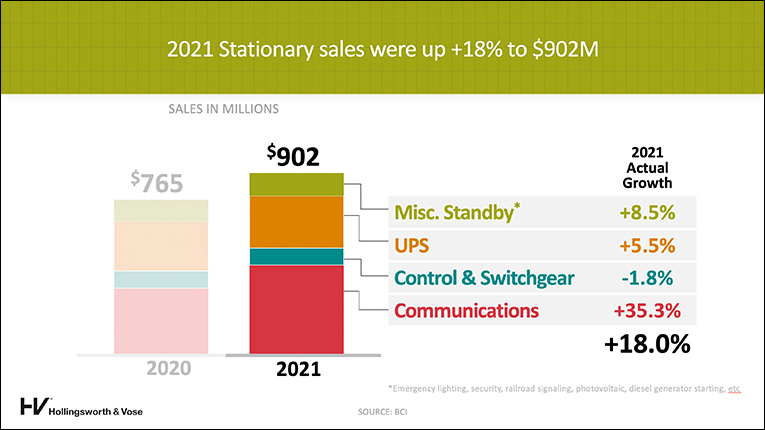

According to BCI members, 2021 was a good year for the stationary market, with stationary sales up 18%. The market is broken out by four segments:

- Miscellaneous Standby (emergency lighting, microgrids, etc.)

- UPS (uninterruptable power supply to bridge gaps during outages)

- Control & Switchgear (mostly utility applications)

- Communications (telecom)

Telecom had an impressive +35.3% CAGR in 2021, ending at $447 million, based on several factors converging:

- Strong growth in wireless and wireline

- More investment at macro sites to prepare for broader 5G rollout

- Renewed focus on network reliability and resiliency

- Replacement market continues to be cyclically strong

“’How long will it last?’ is always the big question,” Starita said. “The consensus is that it could continue for several more years.”

Other trends include the demand for high temperature-tolerant lead batteries, due to their longer life. “There’s still a fair amount of risk-aversion at major carriers when it comes to lithium. Although, we do expect lithium will be a likely solution in small cells,” he added, since there is not much back-up yet up for small cells. “But it will have to happen eventually.”

He also pointed out the rise of nickel batteries in telecom. “We are starting to see and hear anecdotes of nickel doing well in telecom. Its value proposition is a really wide temperature range and long life, but it’s certainly more expensive than lead.”

However, UPS has been a slightly tougher market for domestic BCI members. Lithium-ion has captured some datacenter builds, and low-cost imports squeezed out lead battery replacements. But there was a lot of datacenter activity – up 5.5% to $257 million in 2021.

Starita also reported that edge computing could potentially represent another $30 to $40 million of growth for lead batteries over the next four to five years.

Datacenter Trends

Backup time reduction continues, Starita reported. “The 15-minute standard is long gone. It’s now down to five minutes or less, maybe even pushing one minute, which is tough for the standard lead battery. High-heat lead products are valuable here.”

He said lead batteries could gain ground if they could improve their life span to match UPS (7 to 10 years). Furthermore, “the dust really isn’t settled on fire/safety codes,” which would dilute some of lithium-ion’s value proposition on their footprint savings.

2022–2024 Forecast for Stationary Market

In short, Starita reported there’s a lot less consensus among BCI members within the stationary market, making predictions difficult. Despite this, BCI members’ median forecast is about a 5% CAGR from 2021 to 2024, bringing the stationary market to $1.045 billion. Historically, that number has been .7% annually.

Members provided the most dramatic growth range within telecom. “It could be down 8% or it could be up 26%. We don’t know where the number is going to land,” Starita said.

Overall, Starita said the stationary market seems to have a lot more uncertainty than motive power might have. However, he added that more BCI members report in the stationary battery segment than motive power.

Energy Storage Systems Market: Lead Can Compete

Starita concluded with a quick overview of significant federal and private funding available to try establish a domestic lithium-ion supply chain. He noted that even with lithium-ion’s growth, lead can remain competitive. “The question is, how do we keep the focus on finding and developing [lead battery] niches?”

He closed with saying a lead battery’s reliability and recyclability open up unique opportunities for its future, “so long as we maintain the desire to pursue [them].”